Combating Insurance Fraud Using Technology

The key priorities for the South African Insurance Association’s (SAIA) Motor Insurance portfolio is to adequately and substantially address the affordability of comprehensive vehicle insurance, to contribute to road safety in South Africa and to decrease vehicle crime. The Insurance Crime Bureau (ICB), through bringing together the collective resources of insurers, law enforcement agencies and other stakeholders to facilitate the detection, prevention and mitigation of insurance crimes, assists SAIA and insurers in addressing vehicle crime in various ways.

LPR4SA initiative

“One of the current Motor Insurance portfolio projects includes the License Plate Recognition for South Africa (LPR4SA) initiative,” said Nico Esterhuizen, General Manager of Insurance Risks at SAIA.

“It uses automatic license plate recognition technology. It is a type of technology, mainly software, that enables computer systems to automatically read the registration or license number of vehicles from digital pictures,” he said.

“Reading the registration number automatically means transferring the pixels of a digital image onto a database that is accessible to the ICB, or any of SAIA’s motor insurance members, to identify claims and fraud,” he added.

Unlocking new opportunities

“LPR4SA will unlock new opportunities to SAIA motor insurance members and ICB members to detect and combat insurance fraud”, said Garth de Klerk, CEO of ICB.

“We are also partnering with various private and public entities to expand the service with many more camera sightings, adding significant value to members”, continued de Klerk.

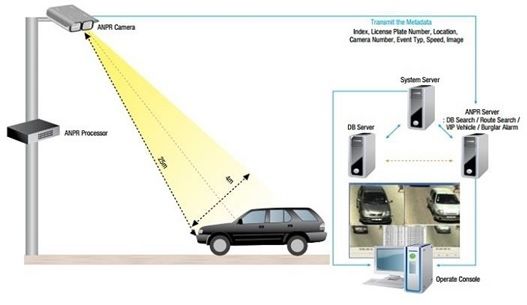

Automatic Number Plate Recognition (ANPR) technology requires various elements and processes as depicted below, including IP Cameras, communications links such as Fibre, Wi-Fi or 3G channels, a very large data base and server where the resultant images are stored, and a user interface add server.

To the benefit of SA society

“It all started eight years ago, when SAIA funded this project under a different name (Business Against Crime of South Africa Automatic Number Plate Recognition – BACSA ANPR), for insurers to verify certain claims. However, over a year ago we partnered with the ICB to expand on the project as they have the necessary technical and operational resources to take the initiative to a larger scale of operations,” said Esterhuizen.

“The project will also benefit the South African society, as the technology assists us to identify criminal elements, and the South African Police Service (SAPS) will also utilize this data in the near future, emphasized de Klerk.

The use of LPR technology is not a new phenomenon however, with the deployment of more fixed and roaming cameras the cost-benefit of these types of investments has become more evident and therefore, SAIA and the ICB, through the guidance of members, are advocating the usage of these type of technologies to combat crime.

Source: https://www.fanews.co.za/article/short-term-insurance/15