Insurance Fraud May Increase With Inflation

South Africans are struggling to cope with the high cost of living and as debt increases, some individuals may be enticed into committing opportunistic crime. This raises concerns that more people may turn to insurance fraud to address the financial pressure they are experiencing.

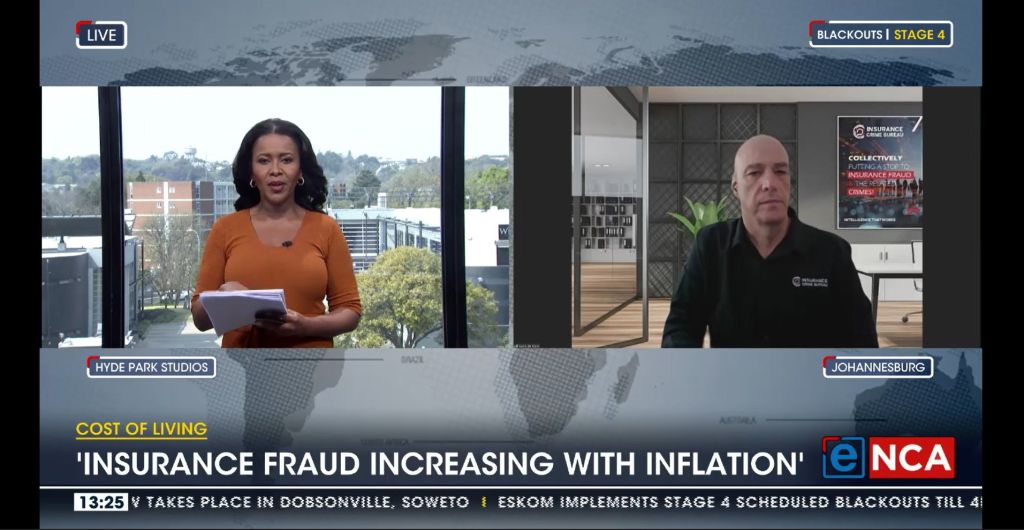

Many individuals justify insurance fraud as a victimless crime. CEO of the Insurance Crime Bureau Garth de Klerk, spoke to eNCA to discuss how lying on application stage to save money and submitting padded / false claims, still remains fraud and is against the Law.

“Unfortunately, the attitude we are finding towards insurance fraud and related crimes is one that it’s a victimless crime, which is far from the truth. Very similar to what we are seeing with online and financial scams, there is always a victim at the end of the road and there is always an impact on society. We have seen an increase in the crime we are experiencing around financial crime and fraud, but we are also seeing a high prosecution rate and convictions.”